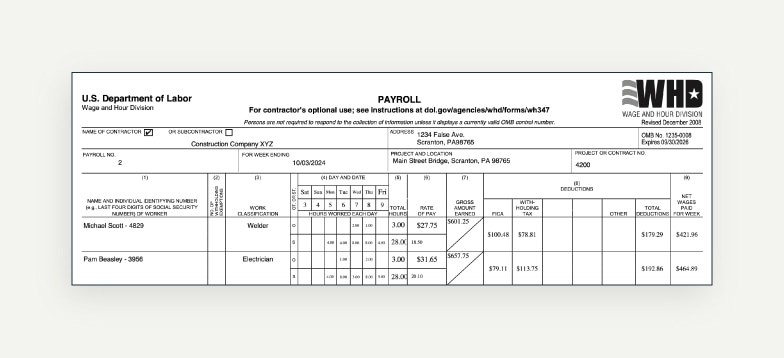

After completing the first page of Form WH-347, don’t forget the second page. The second page is where you “certify” your report.

It includes a statement of compliance that indicates the payroll forms are correct and complete. It asserts the pay for each employee meets the proper prevailing wage.

Certified payroll reporting

Some contractors and payroll providers think they must be a Certified Payroll Professional (CPP) to complete and submit a certified payroll report. That’s not true. Any contractor provider can complete and submit a certified payroll report.

A company owner or payroll manager signs the statement of compliance. In doing so, they understand that the willful falsification of any payroll information may subject the contractor or subcontractor to civil or criminal prosecution.

Who creates certified payroll reports?

Anyone can complete a certified payroll report. The biggest job is gathering the data and completing the form.

It should take less than an hour to gather and compile the information for eight employees on a single report. But you could spend hours just collecting, reviewing, and confirming your payroll data. That’s in addition to generating paychecks and completing a certified payroll report.

This work becomes more time-consuming; the more employees you have, the more jobs you work on. It’s also highly error-prone if you are creating these payroll reports manually.

Best practices for managing certified payroll reports

Better organization makes it easier to fill out and submit your certified payroll reports. Here are a few tips to stay on top of this important task:

- Create a procedures manual: This will help you document the payroll process, where a manual can help you train new team members, work efficiently, and reduce errors.

- Embrace technology: If you’re managing payroll on spreadsheets, you might be using an outdated process. Entering data manually can result in errors, and you risk losing important data.

- Keep records: The Fair Labor Standards Act (FLSA) requires that you keep payroll records for at least three years. So make sure you’re storing them in an organized way. You’ll be glad you did if you ever need to refer back to them.

- Avoid key mistakes: Some contractors and payroll providers believe one payroll form or format will meet certified payroll requirements in all 50 states. However, some states have multiple forms and electronic filing requirements.

Failing to pay the prevailing wage can be costly, as you may have to pay back wages to employees. Plus, not meeting the requirements of the Davis-Bacon Act can lead to contract termination.

Next steps for streamlining your payroll process

Managing payroll is a necessary part of construction accounting for contractors. However, creating and submitting a certified payroll report is an added step for those who work on construction projects.

Automated payroll services and software like QuickBooks Payroll can help you run payroll faster and more accurately. You can also use built-in payroll tools to create a certified payroll report.