Importance of balance sheets and how to use them

The balance sheet is meant to give you a clear view of what your business owes and owns. The insights you can gain from the balance sheet—along with other financial statements—allow you to make informed financial decisions as your business grows.

There are several ways to utilize balance sheets, such as:

1. Determining your business’s ability to meet current financial obligations or defining your working capital. To do this, you will need to know your company’s current ratio and days cash on hand.

- Current ratio is a key financial ratio that will provide insight into whether you can meet your short-term debt payments. Calculate current ratio by dividing current assets by current liabilities.

- Current ratio = current assets / current liabilities.

- Preferably, you want your current ratio to be 2.0 or higher.

- Days cash on hand tells you how many days’ worth of expenses you can cover given your current financial position.

- Days cash on hand = (cash + marketable securities) / ((operating expenses – non-cash expenses) / 365)

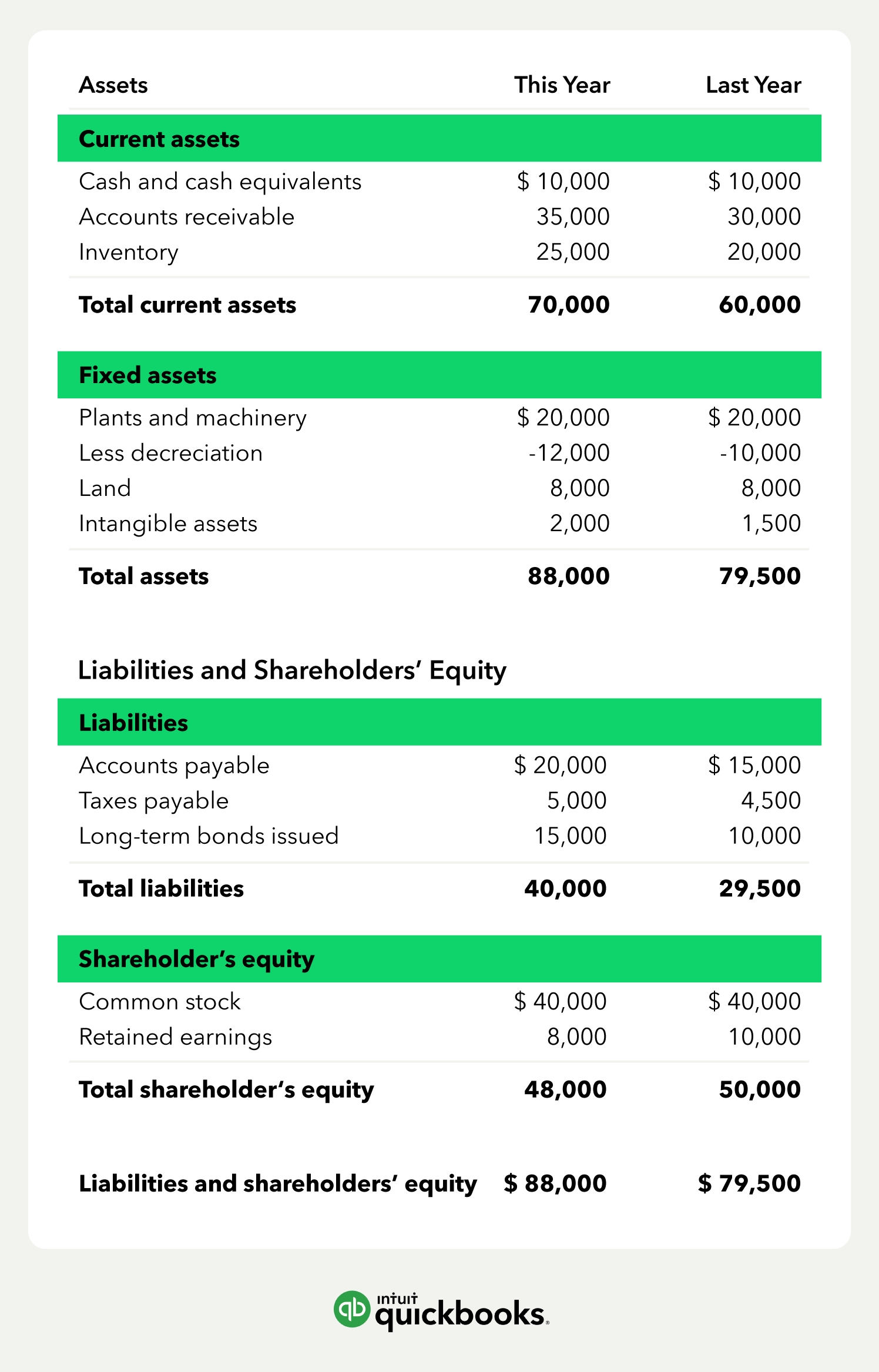

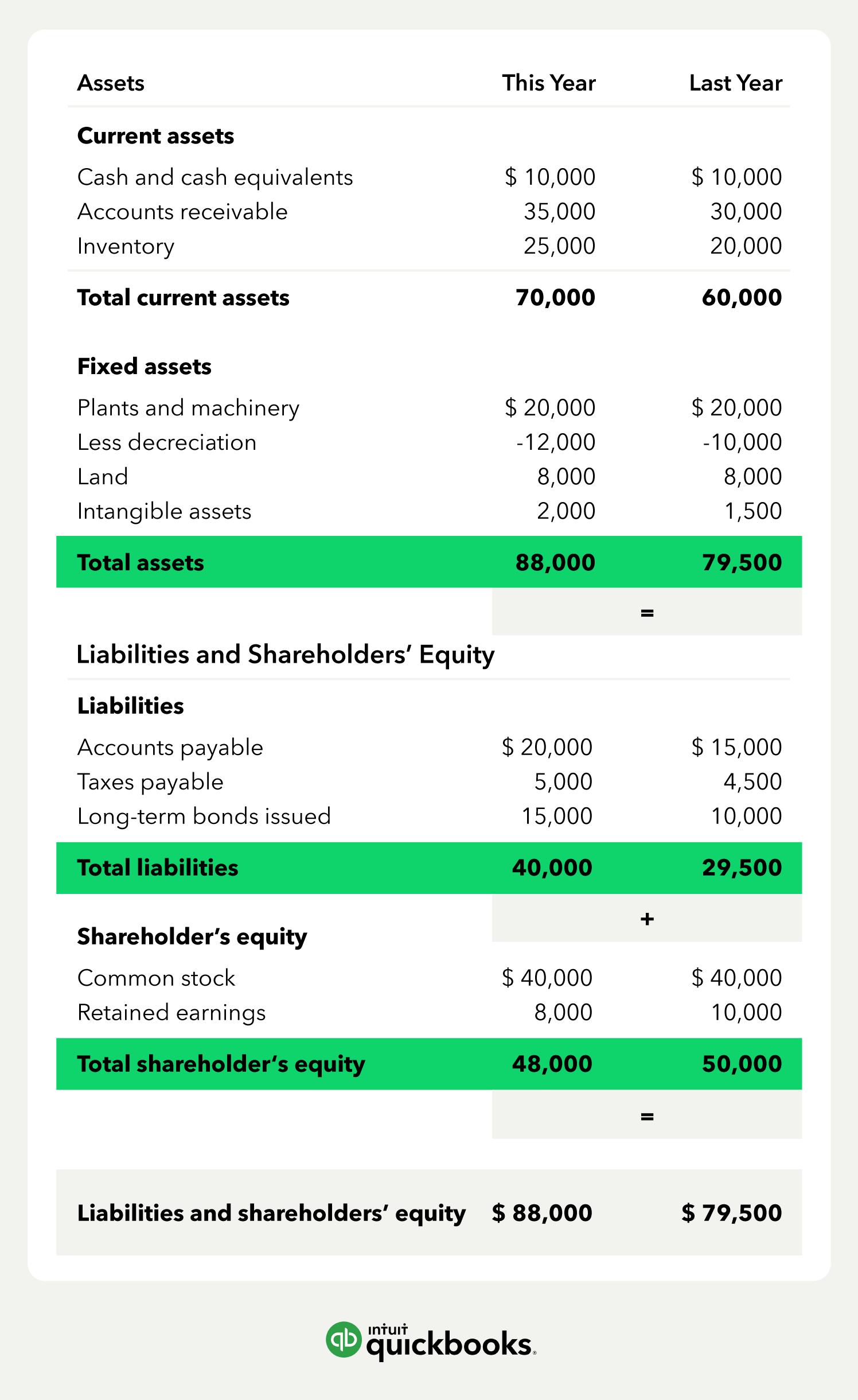

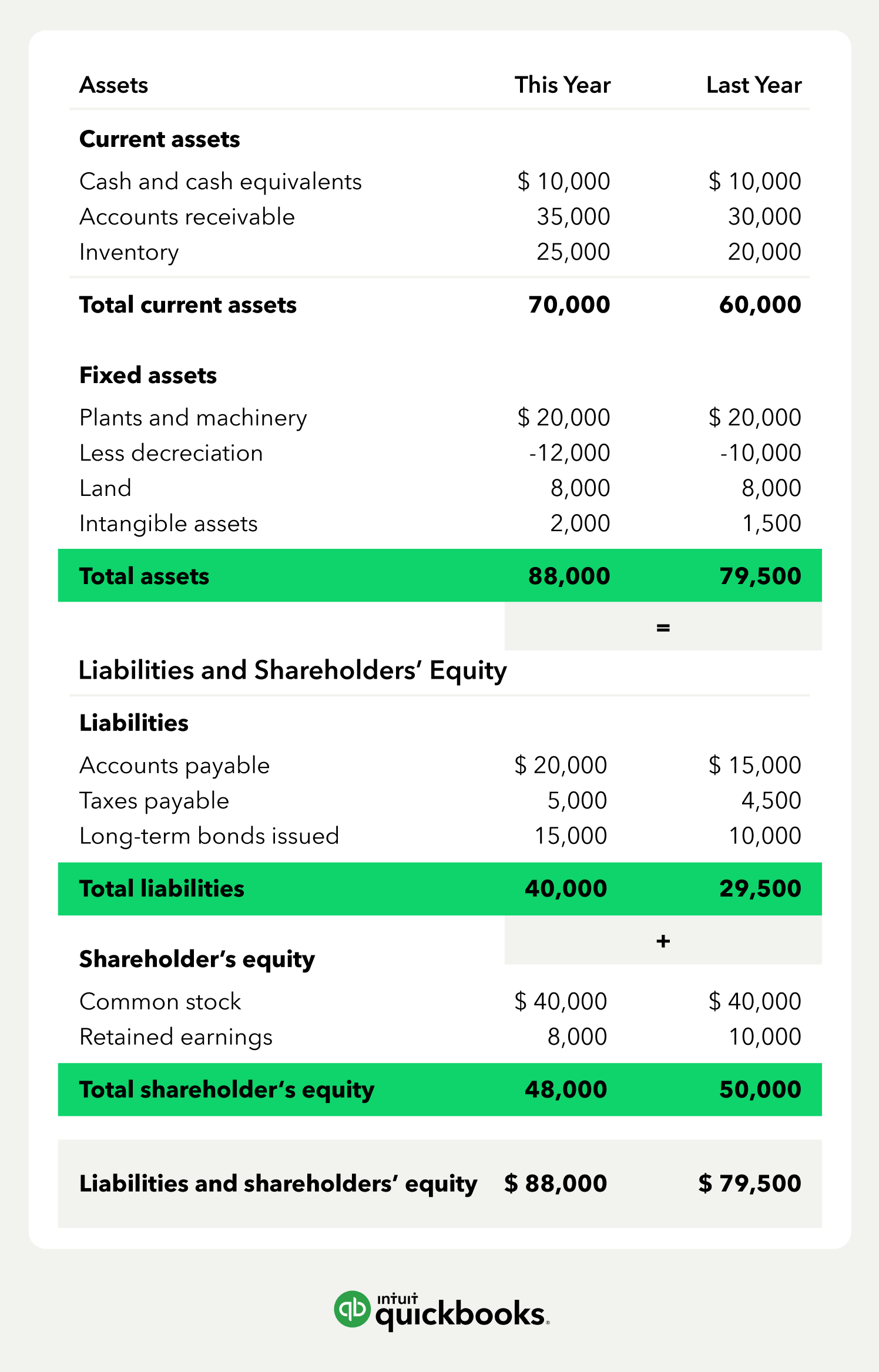

2. Comparing year-over-year or period-over-period. Doing so allows you to see how your financial circumstances have changed and identify areas for opportunity and improvement.

3. Determining your business’s net worth if you intend to sell. Not only will you need to know this figure, but potential buyers will want to know—and have the proof to back it up.

4. Applying for credit. Lenders will want to verify that you are able to pay back your debts.

5. When completing your taxes or providing financial information to regulatory authorities. In some cases, businesses are required to submit their balance sheet and other financial statements for tax purposes.