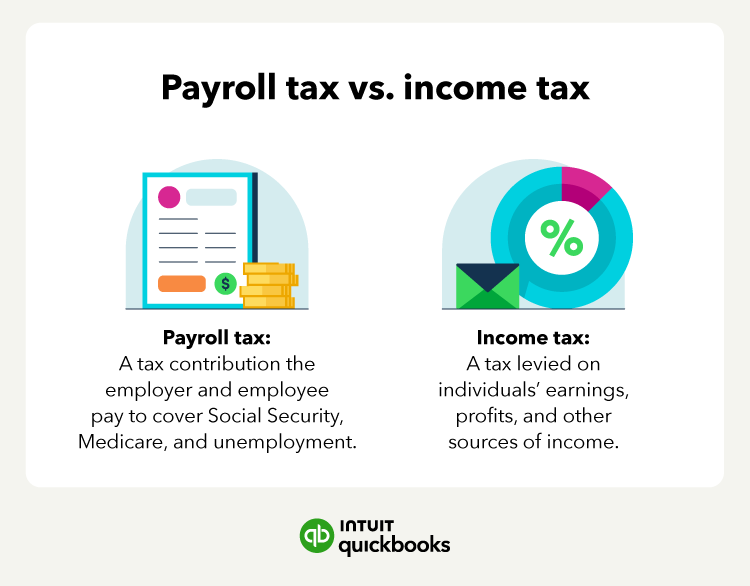

- Application: Payroll tax applies to employees' wages and salaries. Income tax applies to various income sources, including wages, salaries, and business profits.

- Tax rates: The current federal payroll tax rate is 15.3%, which includes both the employer and employee’s contributions. The federal income tax rate ranges from 10% to 37%.

- Tax levies: Payroll tax is a tax the government levies on employers and employees. While income tax is levied on individuals’ salaries, wages, and other incomes.

- Usage: Payroll taxes generally fund three specific programs: Social Security, Medicare, and unemployment benefits. Income taxes fund a wider array of public services and expenditures.

The employer is responsible for withholding the employer’s share of payroll taxes, reporting employee earnings, and remitting deductions from employees’ wages. The employee is responsible for paying federal and state payroll taxes, as well as their income tax.

How to calculate payroll tax

Workers and employers must contribute to Medicare, Social Security, and unemployment compensation by paying payroll taxes. Ultimately, the worker’s gross income determines how much they’ll pay for each of these programs.

The amount deducted is based on the worker’s annual income and the number of allowances computed on Form W-4. Employers will then pass withholding amounts to each taxing authority.

Currently, the employer’s payroll expense is a 6.2% Social Security tax and a 1.45% Medicare tax (7.65% in total). Each worker pays the same 7.65% tax through payroll withholdings.

The current employer’s FUTA tax rate is 6% on the first $7,000 in gross income earned by the worker. If the wages are subject to a state unemployment tax, the employer can use a 5.4% FUTA credit, which reduces the FUTA tax to 0.6%. The total federal and state unemployment taxes will vary depending on each state’s unemployment program.

Here’s an example of how to calculate payroll taxes, if their total income for the year is $25,000:

- Employee tax (FICA): $25,000 x 15.3% = $3,825

- 7.65% paid by the employer = $1,912.50

- 7.65% paid by the employee = $1,912.50

- FUTA tax for one employee: $7,000 x 6% = $420 paid by the employer

How to calculate income tax

To calculate income tax you must first determine an employee’s gross income, which includes wages, salaries, and any other sources of income.

Gross wages may be calculated based on an annual salary or determined using an hourly rate of pay and hours worked. The gross wages paid are your largest payroll expense and include payments to employees and independent contractors.

After that, determine whether they qualify for any adjustments to income, such as contributions to retirement accounts, HSA contributions, and other benefits and deductions. Then, subtract the total of those adjustments from their gross income to determine how much income is taxable.

To determine how much income tax to withhold, refer to the IRS withholding tables or go worry-free with payroll software, such as QuickBooks, that calculates these for you.

Best practices for processing payroll and income taxes

When processing payroll, there are a couple of best practices to follow for handling payroll tax and income tax:

Consider other withholdings

Employers may have to withhold additional amounts that are not related to taxes, such as the worker’s share of health insurance premiums. To pay workers, you start with gross pay (unpaid wages) and deduct withholdings to calculate net pay. Some withholdings are for taxes, and others are not.

Not all workers have taxes withheld from pay, and you need to classify workers as either employees or independent contractors.

Categorize employees and independent contractors

A worker’s classification determines how the worker is treated for tax purposes. If the worker is an employee, you’ll incur payroll expenses. Independent contractors, on the other hand, are personally responsible for all tax withholdings, and the company’s only expense is the gross amount paid for services.

The Internal Revenue Service (IRS) provides a guide that explains how to classify workers to a particular category. The terms of your working relationship determine if the worker is considered an employee or an independent contractor.

The guidelines consider how much control the business has over what the worker does, who provides tools and supplies, and whether you have a written contract. If you have a large amount of control over how and when the worker performs services, they’re likely an employee.

Consider voluntary deductions

If your business offers benefits, you may withhold a portion of the costs from the worker’s pay. The employer’s share of the costs is a payroll expense. Here are some examples:

- Retirement plan: The employee contributions are deducted from pay and are not an employer expense. However, the employer’s share of contributions is a payroll expense for the business. Employer contributions are not deducted from pay.

- Health, dental, vision, and life insurance premiums: Premiums paid by the employer are not withheld from pay and are included as business expenses. The worker’s share of premiums is deducted from pay and is not a payroll expense.

- Union dues: Dues are deducted from pay and forwarded to the union on the worker’s behalf. The payments are not a payroll expense.

- Loan payments: If an employee has a loan from the business, repayments may be deducted from pay and are not a payroll expense.

The cost incurred to retain an accountant or a payroll service company is a business expense. Once you understand the payroll expenses you must incur, create a written procedure that documents how you process payroll.

Complete payroll tax forms

Payroll tax returns are complex, and the information you submit must be accurate. Make sure to submit the forms on time to avoid late filing fees. Here are the most common payroll tax forms businesses must submit:

- Form 941: Reports federal income taxes and FICA taxes to the IRS each quarter.

- Form 940: Employer’s annual federal unemployment (FUTA) tax return.

- Form W-3: Reports the total wages and tax withholdings for each employee using W-2 forms. Businesses file the report with the Social Security Administration annually.

- Form 1096: Reports the dollars paid to independent contractors using 1099 forms. Businesses file this report annually.

Accounting software allows you to generate these reports automatically.

Find peace of mind come tax time

Understanding the difference between payroll tax vs. income tax can help you process your payroll faster and maintain compliance. Use a payroll software or service to process payroll, and take steps to minimize the use of spreadsheets. With these tips in mind, you can save time and process payroll accurately.

QuickBooks Online Payroll & Contractor Payments: Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services, subject to eligibility criteria, credit and application approval. For more information about Intuit Payments Inc.’s money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/