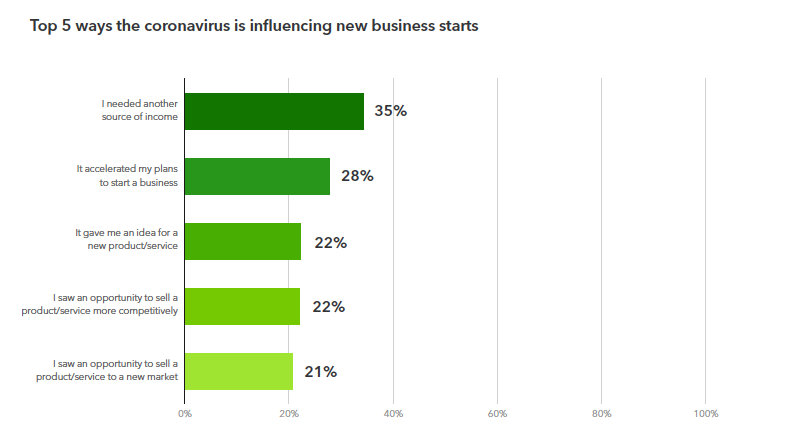

2020 has been a tough year for small businesses. Many have felt the impact of the coronavirus—it’s hit some harder than others. During a time when so many are struggling, it may seem counterintuitive to open a new business. But many aspiring business owners are doing just that. A recent QuickBooks survey of 635 people who plan to open a business within the next 12 months reveals why.

The majority of these aspiring entrepreneurs (85%) say the coronavirus influenced their decision to start a business this year, at least in part. Some were among the millions of Americans left jobless this summer, searching for another source of income. Others saw a prime opportunity to sell new products or services to new markets. But the plurality of new business owners (42%) is finally making their side gig “official.”